Cross Margin vs Isolated Margin Examples

Consider a trader has a position worth 100 XBT at a price of 100 USD. The trader sets their margin method to Isolated Margin and posts 4 XBT worth of initial margin, and their liquidation price is set to 97 USD. Their Margin Balance is now 96 XBT.

Soon after, the price falls 6 USD to 94 USD. On the way down the liquidation engine assumed control of their position at their liquidation price of 97 USD.

The trader has only lost the 4 XBT that they assigned via Isolated Margin but has had their position liquidated. Additional funds were not used to avoid liquidation because Isolated Margin was set. If the trader had used Cross Margin, they would have had a larger unrealised loss (6 XBT), but they would have kept the position from being liquidated.

How to Adjust Leverage and Add Margin to a Position

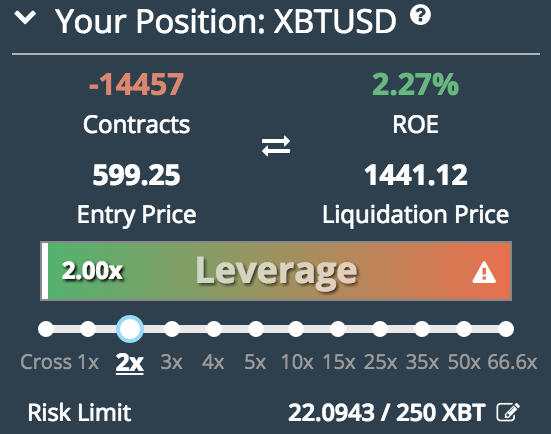

You can use the Leverage Slider as per below to adjust Leverage to a desired level. Adjusting this leverage will affect your Liquidation Price. If you slide it to the far left then you will move out of Isolated Margin and back into Cross Margin.

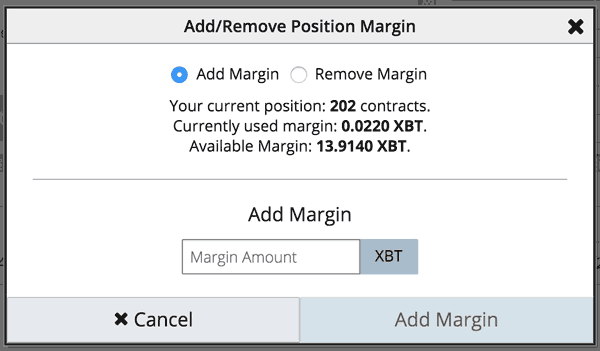

You can also add additional margin to your position via the following method when you have selected Isolated Margin on a position. Note: If you have selected Cross Margin then you are unable to do this.

First click the  /

/  icon next to the margin line-item on an isolated position in the Positions List:

icon next to the margin line-item on an isolated position in the Positions List:

Then choose an amount to add to the position:

After confirmation, note the new margin value, liquidation price, and leverage.

This feature allows you to choose any margin commitment between the minimum (which may be as much as 100x) and your total account balance.

Profit Realisation Examples

Example one:

Karen’s BitMEX account wallet has 10,000 USDT.

She buys 20 contracts of ETHUSDT at the price of $1,000 at 50x Cross Margin.

The required initial margin is 2% = 400 USDT, and the maintenance margin is 1% = 200 USDT.

Her Entry price (avgCostPrice) is 1,000.

Her avgEntry price is also 1,000.

Her liquidation and bankruptcy prices are 510 and 500, respectively.

Her available balance is now USDT 9,600.

The Mark Price moves up to $1,100, hence a profit of 2,000 USDT is realised (remember: this process can happen every 10 minutes).

The required margin is still USDT 400 (maintenance margin is USDT 200).

Her Entry price (avgCostPrice) is still 1,000 (this is the number you will see on BitMEX website).

Her avgEntry price is now 1,100 (the price at which profit was realised).

Her liquidation and bankruptcy prices are 510 and 500, respectively.

Her available balance is now 11,600 USDT.

The Mark Price moves down to 950. A 3,000 USDT loss needs to be pulled from her Wallet (remember: this process can happen whenever the Mark Price updates, i.e. every 5 seconds)

The required margin is still 400 USDT, and the maintenance margin is 200 USDT.

Her Entry price (avgCostPrice) is still 1,000 (this is the number you will see on the BitMEX website).

Her avgEntry price is still 1,100.

Her liquidation and bankruptcy prices are 510 and 500, respectively.

Her available balance is now 8,600 USDT.

The Mark Price moves down to 900 and Karen buys 10 more contracts of ETHUSDT at 900.

The required margin is now 2% of 9,000 (add. position) + 2% of 20,000 (first position) = 580 USDT, and the respective maintenance margin is 290 USDT.

Her Entry price (avgCostPrice) is 966.67

Her avgEntry price is 1,033.33.

Her liquidation and bankruptcy prices are 643 and 633.33, respectively.

Her available balance is now 7,420 USDT.

The Mark Price falls even further to 800 and another 3,000 USDT loss needs to be pulled from the Wallet (remember: this process can happen every 5 seconds).

The required margin remains at 580 USDT, and the maintenance margin remains at 290 USDT.

Her Entry price (avgCostPrice) is still 966.67.

Her avgEntry price is still 1,033.33.

Her liquidation and bankruptcy prices are still 643 and 633.33, respectively.

Her available balance is now 4,420 USDT.

Finally, Karen’s position starts to pay off when the Mark Price rises to 1,200 when profit realisation happens (every 10 minutes). The profit swing is 12,000 USDT, of which 7,000 pays back funds drawn from the Wallet:

30 ETHUSDT x (avgEntryPrice - 800) = 30 x (1033.33-800) = 7,000 USDT

And the remainder is realised profit (compared to the last avgEntryPrice):

30 ETHUSDT x (1200 - avgEntryPrice) = 30 x (1200 - 1033.33) = USDT 5,000

This means that:

The required margin is still 580 USDT, and the maintenance margin is 290 USDT.

Her Entry price (avgCostPrice) is still 966.67.

Her avgEntry price is updated to 1,200.

Her liquidation and bankruptcy prices are still 643 and 633.33, respectively.

Her available balance is now 16,420 USDT.

Example two:

Bryan’s BitMEX account wallet has 5,000 USDT.

He thinks ETHUSDT (Mark Price 1,000) and XBTUSDT (Mark Price 20,000) will diverge with XBTUSDT moving up more than ETHUSDT.

He buys 1 XBT of XBTUSDT at 20,000 - and sells 20 ETH of ETHUSDT at 1,000, both at 50x Cross Margin.

The total required margin is 800 USDT, and the maintenance margin is 400 USDT.

His Entry prices (avgCostPrice) are 20,000 and 1,000.

His avgEntry prices are also 20,000 and 1,000.

His liquidation/bankruptcy prices are 15,600/15,400 and 1,220/1,230, respectively.

His available balance is now USDT 4,200.

His strategy initially proves right; ETHUSDT goes down to 900 and XBTUSDT goes up to 22,000. Profit is realised on both trades (a total of 4,000 USDT).

The total required margin is still 800 USDT, and the maintenance margin is 400 USDT.

His Entry prices (avgCostPrice) are still 20,000 and 1,000.

His avgEntry prices are now 22,000 and 900.

His liquidation/bankruptcy prices are 13,600/13,400 and 1,320/1,330, respectively.

His available balance is now 8,200 USDT.

But then ETHUSDT rallies to 1,300 and XBTUSDT doesn’t move, which means he has lost 8,000 USDT on this move. This loss is drawn from the wallet to his ETHUSDT position.

The total required margin is still 800 USDT, and the maintenance margin is 400 USDT.

His Entry prices (avgCostPrice) are still 20,000 and 1,000.

His avgEntry prices are still 22,000 and 900.

His liquidation/bankruptcy prices are now 21,600/21,400 and 1,320/1,330, respectively.

His available balance is now just 200 USDT.

XBTUSDT then drops to 21,600, and 200 USDT is taken from the wallet to XBTUSDT, but the position is still at the liquidation price, so it is liquidated.

The total required margin is now USDT 400, and the maintenance margin is 200 USDT.

His Entry price (avgCostPrice) is 1,000.

His avgEntry price is 900.

His liquidation/bankruptcy prices are now 1,310/1,320 respectively.

His available balance is now zero.

Unfortunately for Bryan, ETHUSDT trades up a little bit and hits his liquidation price of 1,310 - and his ETHUSDT position is liquidated.

Key points to note about Bryan’s experience:

-

Bryan got liquidated in a winning long position at 21,600, which is above his original entry price of 20,000 - and well above his original liquidation price of 15,600.

-

Bryan got liquidated in his losing short position at 1,310, which is well above his original liquidation price of 1,220.

-

By sharing profit with the losing position from his winning XBTUSDT position, it was liquidated, whereas it would have been intact under isolated marging.

-

His positions were liquidated at nearly the same time.